European leaders are locked into supporting Ukraine at any cost. Given that, they seem committed to breaking a vital part of the international financial system that has benefited them. Before we understand the damage, let’s look at the reason: Ukraine and Russia.

I have dealt with the history of the region and NATO’s role in prompting Putin’s actions in Ukraine. Europe’s political leadership is committed to Ukraine’s victory over Russia and making sure Russia gains no ground from its invasion. That’s not going to happen. Russia controls significant territory in the Donbass area, and it is getting stronger daily vis-à-vis the Ukrainians.

Europe’s elite and the military-industrial complex in the United States think Russia and Putin are the epitome of evil. They are determined to “win” in Ukraine by any means necessary. Now they are willing to destroy their advantages in international finance by breaking the critical rules that made everyone willing to park money with them.

Normal people and companies hold assets in banks, bonds, and other investments. Nation-states do the same thing. Their funds are called Sovereign Reserves since they are the property of a national entity. It has been understood that these funds are not tools and playthings. A nation holding them has certain obligations of neutrality in dealing with them. It is a fundamental rule that Sovereign Reserves are untouchable regardless of conflict or political enmity.

Countries that follow those rules benefit because other nations use their currency and buy their bonds. But the current leadership in Europe and some in the United States have already bent the rules and are about to break them completely.

Canadian Prime Minister Justin Trudeau ordered banks to freeze accounts of truckers protesting COVID-19 regulations. It worked in Canada.

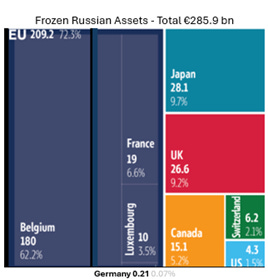

When the Russian-Ukrainian conflict began in February 2022, the Central Bank of Russia (CBR) ‘s assets around the world were “frozen.” This was one of the measures designed to harm the Russian economy and force Russia to withdraw. Russia is a nation. It didn’t work against them. They are still fighting, going on four years later.

Even countries that might disapprove of Russia’s conduct are concerned about this action. That concern led them to consider changing their procedures to protect themselves against the West’s indifference to established rules and norms.

A group of countries, led by five (Brazil, Russia, India, China, and South Africa), known as BRICS, accelerated efforts to develop an alternative to the U.S.–European financial system. There are now 10 countries in the BRICS, and they are working on other options for the International Monetary Fund and on different ways to store sovereign wealth.

For many reasons, including fraud, Ukraine is desperate for money. The sanctions on Russia have backfired in Europe and ruined their economies. Between that, the costs of open migration, and the money they’ve already sent to Ukraine, their budgets are in chaos. They have no funds to spare. Being desperate, they are looking for a way to justify using Russia’s money to help Russia’s opponent without being accused of stealing the money Russia entrusted to them.

Members of the European Parliamentary Research Service provided one analysis. It is what would be expected from support staff on one side of the issue. It lists the options and excuses they produced.

Columbia Professor Jeffrey Sachs’s 22-minute YouTube talk covers the problem from both sides and explains its severity. He notes the core problem is the central principle that is being broken: Sovereign Reserves are untouchable regardless of conflict or political enmity.

The European leaders don’t have the money to keep Ukraine afloat, so they are going to use Russia’s money as collateral for a loan. When Russia loses the war and must pay reparations, that money will repay the loan, and the collateral will be covered. But Russia doesn’t plan to fail. In fact, they now have every incentive to keep going.

In the meantime, there are almost a trillion dollars’ worth of Western companies’ assets in Russia, and they will be subject to quite different new rules. Russia will get its money back through them.

A factor holding up this scheme is the possible liability of the nations and banks holding the CBR’s funds. Most of the funds in Europe are held by Euroclear, a global provider of Financial Market Infrastructure (FMI) services, headquartered in Belgium. Both Euroclear and the Belgian government are worried that any attempt to use Russian assets will prompt immediate legal action by Russia. Alexander Mercouris has a video discussing the delay in this action and the opposition to the idea.

The use of currency and banking as political tools is dangerous. After the United States froze Russia’s access to the dollar, Saudi Arabia refused to renew its longstanding rule requiring all oil purchases to be made in dollars. Playing games with Russia’s Sovereign Assets, no matter how righteous you think you are, will have a significant adverse effect on the position of all the countries involved in terms of both their currency and their status as trustworthy places to hold wealth.