President Trump is a wealthy man with wealthy friends. He is accused of trying to help his friends when he argues for lowering tax rates. Political enemies, their media allies, and others are eager to assume that his wealth is the only reason he wants lower rates. But that is not true.

Taxes are necessary to fund any government. The obvious question is how to raise them in a way that causes the least harm to the economy and efficiently increases the needed funds. A complex system with loads of favoritism causes harm and raises relatively little.

There is a simple rule in life we all follow. I deserve to have more money and pay less for what I want. We all know that is true. There’s an obvious problem. We all feel that, at some level, government tax policy needs to be set to ensure everyone is amenable to paying taxes instead of working hard or, in some cases, stopping work to avoid paying more taxes.

There is also a human trait of being sure that “those people are too rich” and should be paying “their fair share.” Politicians use this standard trope to appeal to our envy. The tax laws are then used to set higher rates to “Tax the Rich.”

Thomas Sowell earned his Doctorate in Economics at the University of Chicago and became a member of the Hoover Institution at Stanford after teaching at several prestigious universities. His Basic Economics is an excellent lay reader’s guide to the field. Amazingly, it is economics without graphs or advanced mathematics. Sowell understands a complex field so well that he can explain it to laypeople straightforwardly.

He was annoyed by the claim that proponents argued for a “trickle down” theory that tax cuts gave the rich more money that would then “trickle down” to the masses. That was never the thinking behind lower, more reasonable rates on higher incomes. He wrote a 22-page booklet called Trickle Down Theory and Tax Cuts for the Rich to explain the reality. The Kindle version is $1.99.

Reality is simple. Even wealthy people react to incentives and disincentives. The income tax started in 1913. With World War I, the top rate went from 6% to 77% by 1918.

There were 206 people who reported annual taxable incomes of one million [1916] dollars or more in 1916. But, as the tax rates rose, that number fell drastically, to just 21 people by 1921.

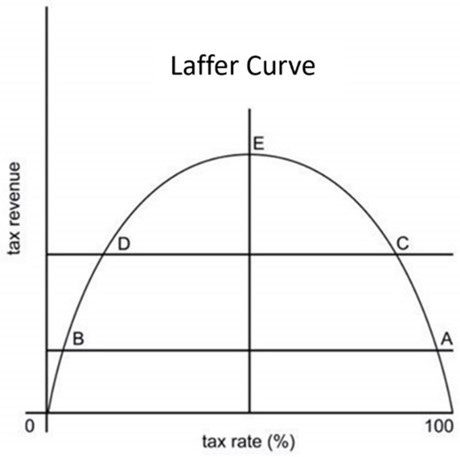

Arthur Laffer described this effect with the “Laffer curve.” The idea is simple. People work or put their money at risk for their benefit. When the tax rates get too high, they look for alternatives to giving the government money. They stop earning more money, earn tax-exempt money, or pay expert lawyers and accountants to help them pay less taxes.

Just as labor cannot be forced to work against its will, so it can be taken for granted that capital will not work unless the return is worth while. It will continue to retire into the shelter of tax-exempt bonds, which offer both security and immunity from the tax collector.

Parked capital has two problematic effects. The rich don’t take risks and invest in new ventures to produce jobs and economic growth. The economy is comparatively stagnant. The taxpayers who were lower on the scale bear more load than otherwise.

During the Harding and Coolidge Presidencies in the early and mid-1920s, Treasury Secretary Andrew Mellon worked to lower the upper tax rate. Wealthy people moved their money out of tax-exempt state bonds and paid more dollars in taxes, but they were willing to do so because the percentage of income was more reasonable.

President Calvin Coolidge was in fact quite explicit that the primary purpose of lowering tax rates was for the government to collect more tax revenues:

The first object of taxation is to secure revenue. When the taxation of large incomes is approached with this in view, the problem is to find a rate which will produce the largest returns. Experience does not show that the higher rate produces the larger revenue. . . .

In the 1950s, Elvis Presley’s manager, Col. Tom Parker, bragged about working to keep Presley in the 90% tax bracket. President Kennedy passed legislation to lower rates. Ronald Reagan majored in economics at Eureka College and reduced tax rates. Revenue increased both times. The deficit was increased under Reagan, but Congress could simply outspend any revenue.

Politicians want voters to believe they can give us stuff and make someone else pay. It doesn’t work. Everyone feels the same way we do about taxes. They don’t want to spend any more than they must. When the tax rates get confiscatory, people will stop generating taxable income. They are not foolish enough to put out effort or take a risk when 80 or 90 percent of the proceeds are taken in taxes.

They are not the only losers. Capitalist risk-taking creates jobs and new technologies. No risk means no growth. “Punishing the rich” hurts everybody in more ways than one.

Well written…excellent point!